The USD/CHF pair is advancing towards its 2024 high of 0.9225 following a strong 256K rise in US Non-Farm Payrolls (NFP), and the exchange rate may continue to follow the upward trend established by the 50-Day Simple Moving Average (SMA) at 0.8895, remaining above this key support level. This sets the stage for the US Dollar Outlook in 2025, with potential for continued strength in the coming year.

US Dollar Prediction: USD/CHF Heading for 2024 High

USD/CHF has extended its upward momentum with a series of higher highs and lows, pushing the Relative Strength Index (RSI) into overbought territory. A move above 70 in the RSI could signal further gains in the exchange rate, similar to the trend seen last year.

US Economic Calendar and Potential Impact on USD/CHF

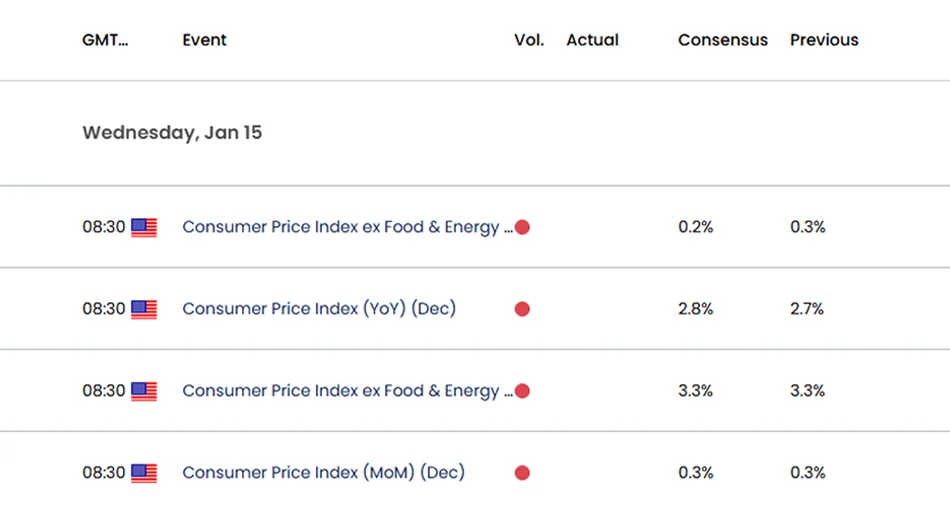

Looking ahead, the upcoming update to the US Consumer Price Index (CPI) could influence the direction of USD/CHF. The CPI report is expected to show an increase to 2.8% in December, up from 2.7% the previous month, while the core CPI is anticipated to remain steady at 3.3%.

If inflation continues to be persistent, the US Dollar could see further strength, adding pressure on the Federal Reserve to pause its rate-cutting cycle. However, a weaker-than-expected CPI report could weigh on the US Dollar, increasing speculation about the possibility of lower interest rates.

If the momentum fails to break above the 2024 high of 0.9225, the RSI might remain out of overbought conditions, but USD/CHF could continue to rise in the coming days if the bullish trend remains intact.

USD/CHF Daily Price Chart

- USD/CHF has experienced a four-day rally, extending its climb from the monthly low of 0.9009. A break above the 2024 high of 0.9225 could open the door for a further advance toward the October 2023 high of 0.9245.

- The next significant level to watch is the 2023 high of 0.9440, but USD/CHF may struggle to maintain its upward trajectory if it fails to test the 2024 high of 0.9225.

- A lack of momentum to surpass the 0.9180 mark (23.6% Fibonacci extension) could lead the pair to retreat toward the 0.9030 (38.2% Fibonacci extension) to 0.9040 (23.6% Fibonacci extension) region. A drop below the monthly low of 0.9009 would bring the 0.8880 (38.2% Fibonacci retracement) to 0.8910 (38.2% Fibonacci extension) area into focus.

Endnote

In summary, USD/CHF is showing strong bullish momentum, driven by positive US economic data and the potential for continued inflationary pressures. The pair is approaching key resistance levels, with the 2024 high of 0.9225 in focus. However, a lack of momentum to break this level could result in a pullback, with support levels around 0.9009 and 0.8880 offering potential rebounds. Investors will need to closely monitor upcoming economic data, especially the CPI report, as it could significantly influence the direction of USD/CHF in the days ahead.