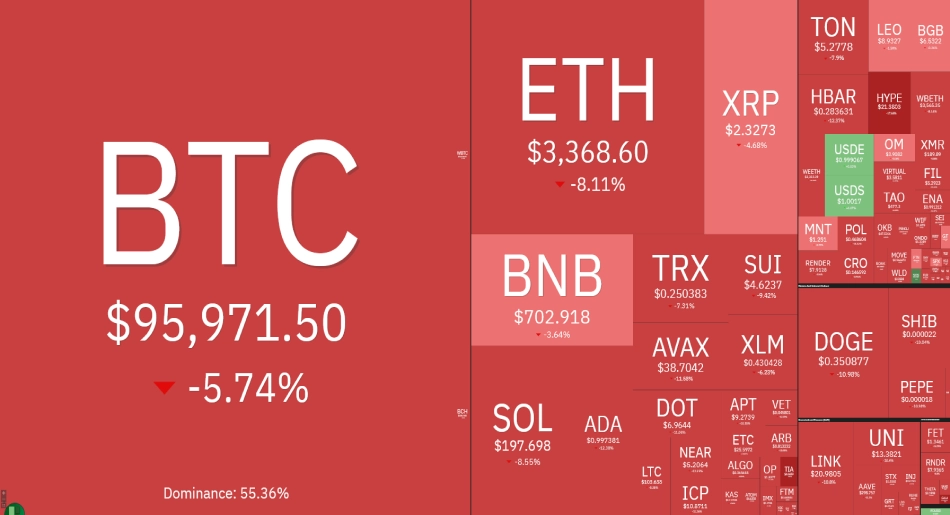

The cryptocurrency market experienced a significant drop today, primarily due to Bitcoin‘s immediate retreat from the $100,000 mark after the release of strong US economic data. As a result, the total market capitalization of cryptocurrencies fell by around 6.3%, reaching approximately $3.35 trillion on January 8, with the market reacting to expectations of potential interest rate hikes.

Let’s delve into the factors that are driving the downturn in the crypto market today.

Bitcoin Leads the Downturn

The recent decline in the crypto market is part of a larger correction that began on January 7, during the early hours of New York trading, when Bitcoin (BTC) fell below the $100,000 level. This decline followed the release of two stronger-than-expected US economic reports, which dampened the early-year optimism surrounding crypto assets.

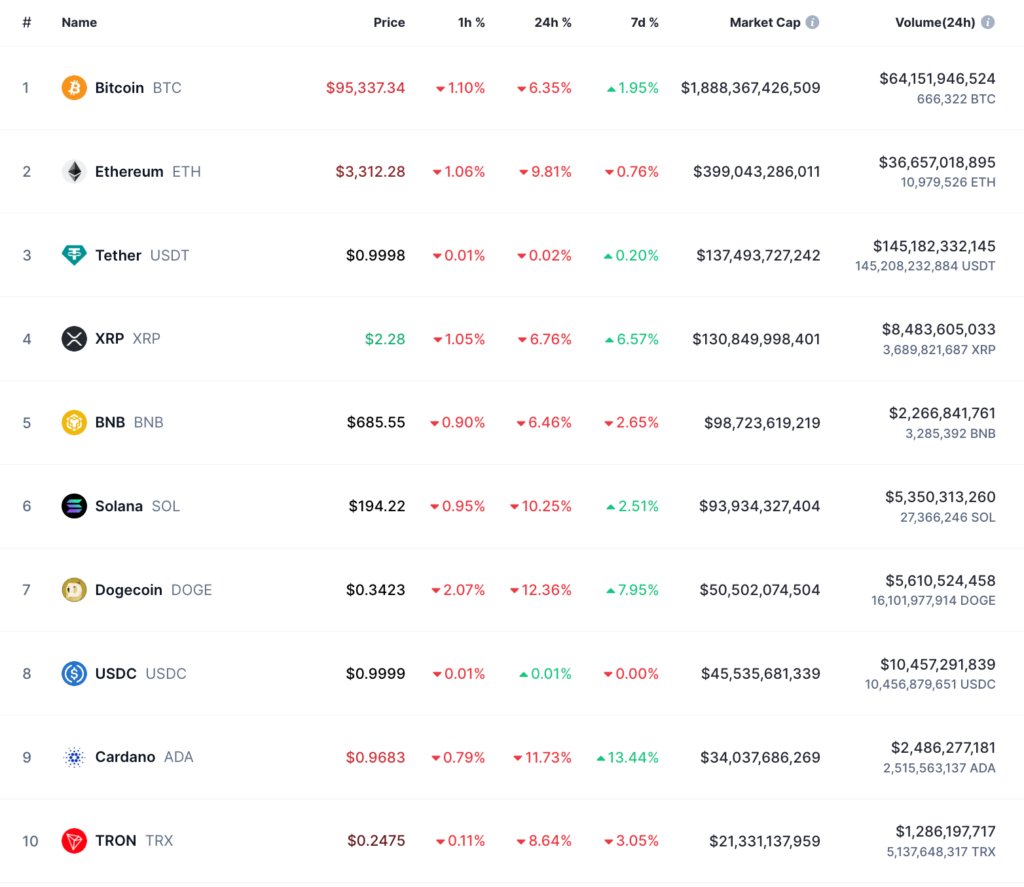

Bitcoin’s price dropped by as much as 6.35%, reaching an intra-day low of $95,279 on January 8. This significant decrease in the value of the leading cryptocurrency triggered widespread panic selling among investors, causing prices to fall across other crypto assets as well.

Ethereum (ETH) also experienced a sharp drop, erasing all the gains it had made over the past week, reaching a low of $3,300 on January 8, which marked a 10% loss within the last 24 hours.

Other major cryptocurrencies, such as Dogecoin (DOGE), Cardano (ADA), and Solana (SOL), also saw considerable losses. Dogecoin was down 12%, Cardano saw a decline of 11.7%, and Solana dropped by 10%.

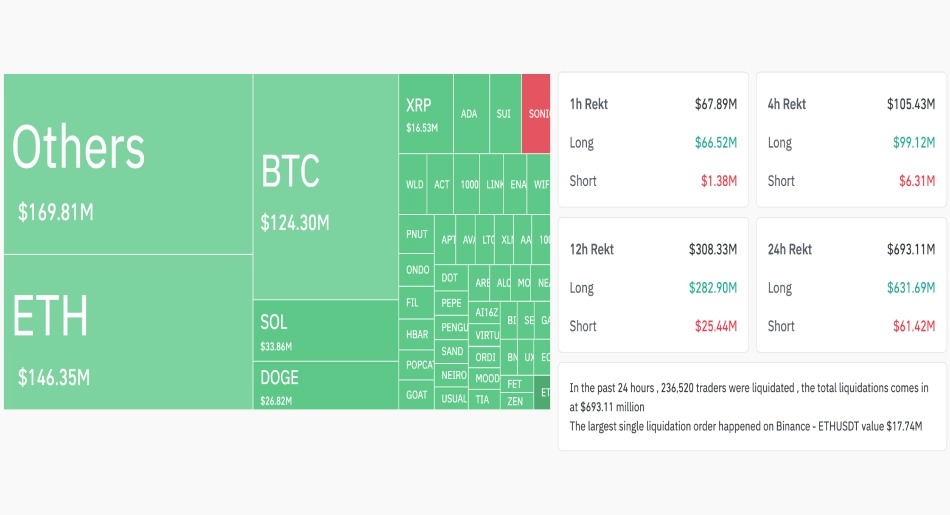

This sharp market decline resulted in the liquidation of nearly $631 million in long positions across derivatives markets, where investors had been betting on rising prices. according to CoinGlass, This marked the first significant leverage flush of the year. Long positions in Bitcoin alone accounted for $111 million in liquidations.

A similar event occurred on December 18, when over $844 million in long positions were liquidated. This followed a 12% drop in the total market capitalization of all cryptocurrencies, wiping off more than $1.2 billion from the market.

The predominance of long liquidations suggests that many investors had over-leveraged themselves in anticipation of further price increases, only to be caught off guard by the risk-off sentiment triggered by the strong US economic data.

US Economic Data Sparks Risk-Off Sentiment

The ongoing correction in the crypto market mirrors the weakness observed in US equities. The S&P 500 dropped 1.1% to close at 5,509.03 on January 7, while the Nasdaq composite index lost 375 points.

The Dow Jones index also posted its second consecutive daily loss, falling 0.61% and closing at 42,528.36 on January 7.

“The S&P 500 is now down 75 points today and has erased its year-to-date gain,” said capital markets commentator The Kobeissi Letter in response to the market’s reaction to the economic data prints.

📌“Over $625 billion of market cap has been erased from the stock market today!”

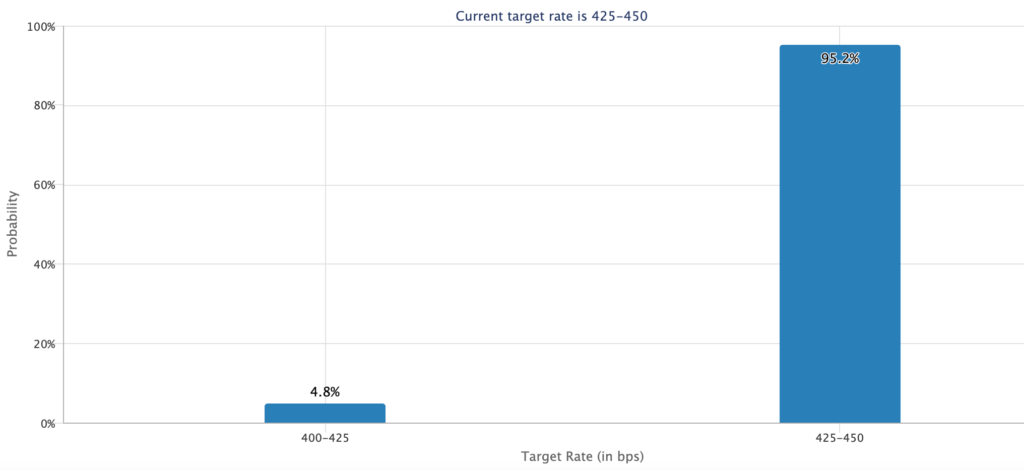

As a result of the strong US economic data, investors have reduced their expectations of interest rate cuts by the Federal Reserve in 2025. This shift in sentiment has had a negative impact on the market’s outlook for riskier assets like cryptocurrencies.

Market participants now see a 95% chance that interest rates will remain unchanged during the Federal Reserve’s meeting on January 29, up from 90.4% a week ago and 62.7% a month ago, according to the CME FedWatch tool.

Looking further ahead, the probability of rate cuts in March and May is below 50%, with odds of 37% and 42%, respectively.

Crypto Market Faces Resistance at the 50-SMA

The recent downturn has caused the total market capitalization of cryptocurrencies (TOTAL) to fall below the 50-day simple moving average (SMA) at $3.35 trillion, which had previously acted as a support level.

Today’s price drop is also preceded by a bearish divergence between the market’s price and its relative strength index (RSI). From November 5 to December 31, the TOTAL market capitalization rose, forming a series of higher lows. However, during the same period, the daily RSI descended, forming lower lows.

This divergence, where prices rise but the RSI falls, signals weakness in the prevailing uptrend and has prompted traders to sell at local price highs.

If selling pressure continues to increase, it is likely that the crypto market could fall toward the $3.18 trillion support level, which has been reinforced by an ascending trendline since the US election on November 5.

Alternatively, if buying pressure picks up, the crypto market could push back above the 50-day SMA and potentially reach the recent high of $3.54 trillion, which was recorded on January 6.

Closing Sentence

In conclusion, the recent fluctuations in the crypto market highlight its sensitivity to economic data. Investors must stay prepared to handle such corrections and not overlook thorough analysis of both economic and technical trends.