While some analysts anticipate a reversal in Bitcoin’s price, prominent Bitcoin analyst Willy Woo cautions traders to brace for heightened risk in the coming months. This Bitcoin trader warning about peak risk highlights the potential volatility and uncertainty that may dominate the market ahead.

Bitcoin Market Faces Heightened Risk Levels

Bitcoin analyst Willy Woo has issued a warning to market participants, advising them to approach the crypto market with caution as profit-taking surges.

📌“Risk is peaking for the first time in this cycle. There’s substantial profit-taking happening now, and more is likely before the market fully resets,” Woo shared in a Jan. 10 post on X.

Despite the prevailing bullish sentiment, Woo recommends a conservative strategy in the months ahead. His Bitcoin risk model, which tracks market risk levels, suggests that current conditions resemble those seen in January 2023.

The Fear and Greed Index, a tool used to measure market sentiment, currently displays a “Greed” score of 69-up significantly from the neutral level of 50 observed on Jan. 10. However, this optimism has not prevented Bitcoin from slipping below the $100,000 psychological level.

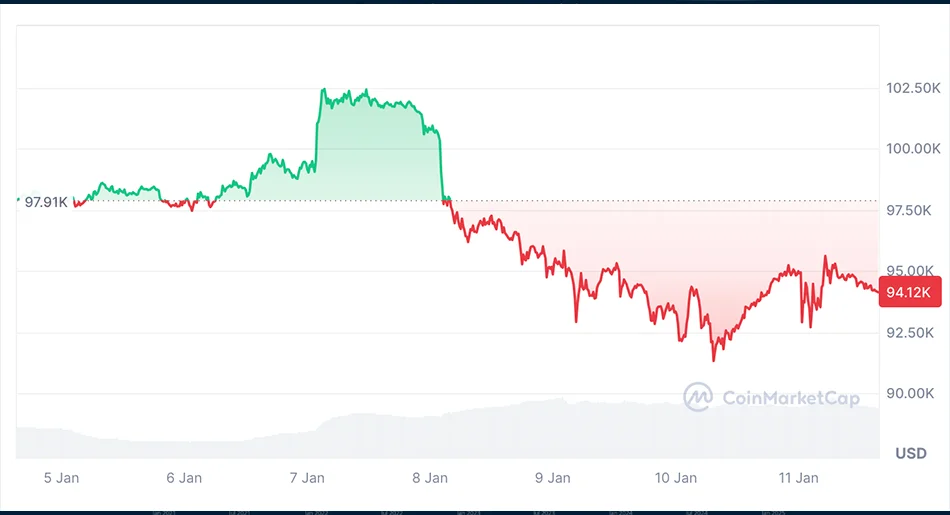

Bitcoin trades at $94,120, marking a 3.92% decline over the past week, according to CoinMarketCap.

Diverging Opinions Among Analysts

While Woo emphasizes caution, not all analysts share his outlook. Some see the current dip as an opportunity for recovery.

Crypto trader Rekt Capital noted in a Jan. 10 X post that Bitcoin’s recent 15% retracement from its Dec. 17 all-time high of $108,000 aligns with patterns observed in previous market cycles.

📢“The timing of this correction matches historical trends, making a reversal highly probable,” Rekt Capital explained.

📢Similarly, Samson Mow, CEO of Jan3, offered a more optimistic perspective. In his Jan. 10 post to over 327,000 followers, Mow expressed confidence in Bitcoin’s long-term strength.

“If you understand the macroeconomic landscape, you’ll see that all dips are artificial now,” Mow argued, suggesting that such movements are orchestrated to facilitate lower entry points for large-scale investors.

What Lies Ahead for Bitcoin?

As the crypto market navigates this uncertain phase, traders face contrasting views. While risk models and sentiment indicators hint at caution, some analysts believe the retracement is part of Bitcoin’s natural growth cycle.

For now, the market remains at a crossroads, leaving traders to decide whether to tread carefully or seize the opportunity for potential gains.

Frequently Asked Questions (FAQs)

Here, we have answered the frequently asked questions that you might have:

Bitcoin’s risk levels are peaking due to increased profit-taking and market overextension. Analysts recommend caution as the market undergoes a reset.

The Fear and Greed Index shows a “Greed” score of 69, suggesting that market participants remain optimistic despite recent price drops.

Some analysts believe the pullback aligns with historical patterns, indicating a high probability of reversal in the near future.

Strong macroeconomic data, profit-taking, and market manipulation by large players are contributing to Bitcoin’s recent price decline.