The launch of the Official Trump’s memecoin has taken the crypto market by storm, potentially driving Solana’s recent price surge to new all-time highs. However, the key question remains: is this rally built to last?

On January 18, the cryptocurrency market was caught off guard by the unexpected launch of the “Official Trump” (TRUMP) memecoin, which was endorsed by President-elect Donald Trump. The announcement was made through Trump’s social media channels, directing followers to purchase the Solana based token via a specified centralized platform and providing the contract address.

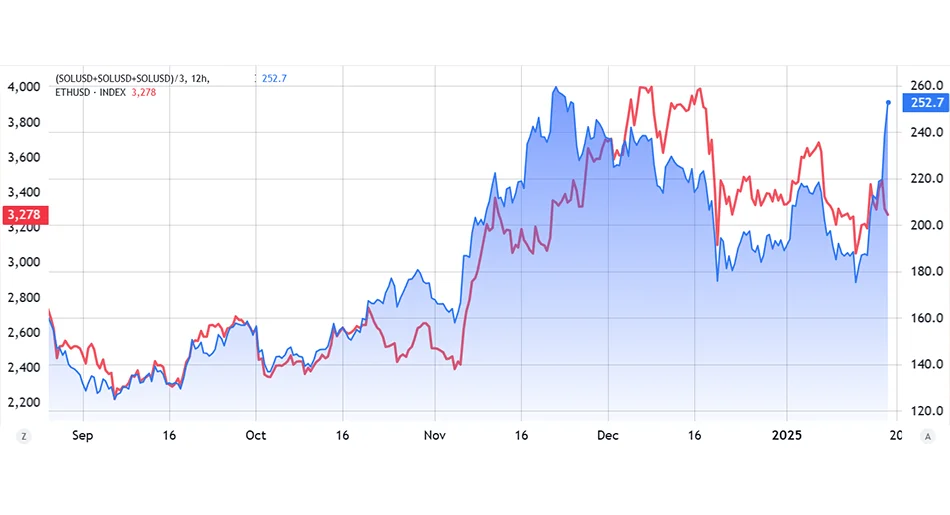

The launch of the memecoin led to a significant rally in Solana’s native token, which soared to an all-time high of $270. This surge has prompted traders to question the sustainability of SOL’s current market capitalization of $120 billion and what this might mean for Ethereum, Solana’s primary competitor. Ethereum had long been considered Trump’s blockchain of choice, largely due to its involvement in World Liberty Financial, a project linked to Trump. However, the decision to launch the Official Trump token on Solana’s network has sparked significant surprise and intrigue within the crypto community.

Official Trump Launch Timing Aligns with ‘America First’ Vision

Adding to the excitement was the strategic timing of the launch, which coincided with the Trump honoring “Crypto Ball,” a prestigious event that gathered industry heavyweights like MicroStrategy’s Michael Saylor, Coinbase CEO Brian Armstrong, the Winklevoss twins of Gemini, and David Sacks, Trump’s advisor on crypto and artificial intelligence. The sold-out gathering was held just a few blocks from the White House in Washington, D.C.

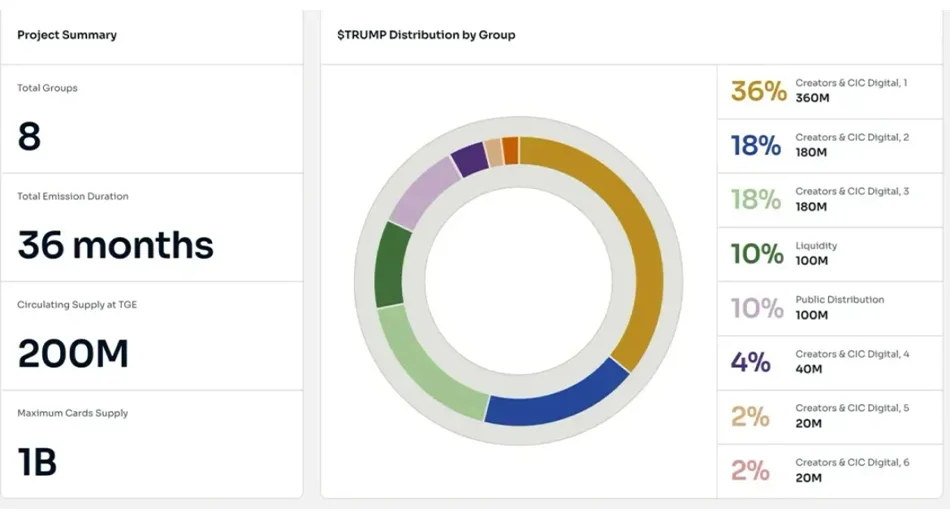

Despite fierce competition in the memecoin market, the “Official Trump” (TRUMP) token quickly surged, reaching an impressive $6.9 billion market capitalization. It was promptly listed on major exchanges such as Bybit, Bitget, and KuCoin. The memecoin debuted with 200 million tokens in circulation and a total supply capped at 1 billion, with 80% of the supply allocated to the issuers.

Liquidity Strategy Boosts Trump’s Memecoin Performance

Issuers strategically deposited 44.4 million TRUMP tokens into single-sided liquidity pools, avoiding direct pairing with stablecoins or other assets. The decentralized exchange Meteora (DEX) was tasked with managing the automated market making (AMM) process in collaboration with Jupiter DEX. The two largest liquidity pools include TRUMP USDC, boasting a total value locked (TVL) of $483 million, and TRUMP-SOL, holding $67 million.

Currently priced at $24.60, the “Official Trump” (TRUMP) token has secured the 28th spot among cryptocurrencies by market capitalization, with trading volumes exceeding $7 billion across both decentralized and centralized exchanges. Remarkably, TRUMP’s trading volume has outpaced Dogecoin (DOGE), the pioneer memecoin with a $58 billion market cap.

The launch of the TRUMP token has significantly boosted Solana’s decentralized platforms, including Meteora and Raydium, further solidifying their positions in the crypto ecosystem.

Official Trump Memecoin Strengthens Solana’s Lead in Crypto and DeFi

The launch of the “Official Trump” (TRUMP) memecoin has shifted the dynamics of the memecoin market, bolstering Solana’s influence in the cryptocurrency and DeFi sectors. With over 200,000 users purchasing TRUMP through its dedicated app, Moonshot, the platform facilitated an impressive $400 million in trading volume.

This shift in focus to TRUMP had a notable impact on the broader memecoin market. Dogecoin (DOGE) saw a 6% decline, Shiba Inu (SHIB) dropped 7.5%, PEPE fell by 10.5%, and Dogwifhat (WIF) experienced an 8% decrease, underscoring the disruptive effect of the President-elect’s token on its competitors.

For Ether holders, the situation presented two key challenges. Firstly, it elevated Solana as the preferred platform for token launches, further solidifying its competitive edge over Ethereum. Secondly, it reduced optimism that the Trump administration might lean toward Ethereum, despite Trump’s earlier involvement with the Ethereum-based World Liberty Finance initiative.

The question of whether the “Official Trump” (TRUMP) token can hold its value above $20 remains open. Additionally, for Solana’s price to cross the $300 threshold, the network needs to achieve notable growth in deposits and institutional interest. This progress heavily relies on the potential approval of a Solana spot ETF by the US Securities and Exchange Commission, a critical factor for future advancements.