Gold has been a standout performer in recent years, gaining nearly 30% in 2024 and surpassing most commodities and assets. With retail traders and industry experts showing bullish sentiment, the gold price outlook for 2025 raises the question: will gold price breach the $3,000 mark?

Gold’s Journey in 2024

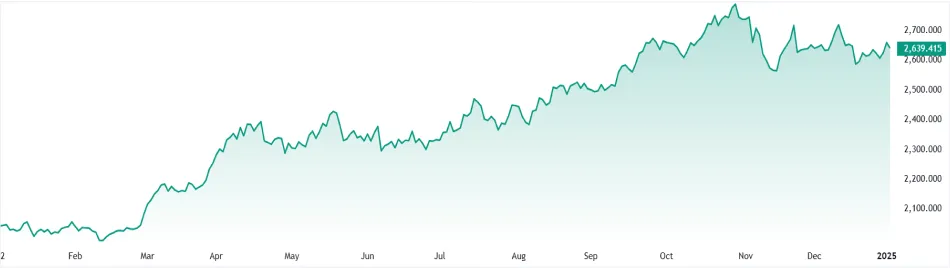

Gold kicked off 2024 strong, hovering around $2,000 per ounce. February saw a dip to $1,992, but by March, the yellow metal surged past $2,100, starting a steep ascent. A significant rally in late April pushed prices above $2,400, though a brief consolidation brought prices back below $2,300.

📌 The biggest leap came in June when gold decisively broke the $2,400 resistance. From there, it steadily climbed, reaching an all-time high of $2,788.54 per ounce on October 30, 2024. However, the U.S. presidential election in November triggered a temporary decline as gold slid to the $2,560 range.

Despite these fluctuations, the precious metal regained momentum, supported by inflation fears and geopolitical uncertainties, ending the year with strong support at $2,600 per ounce.

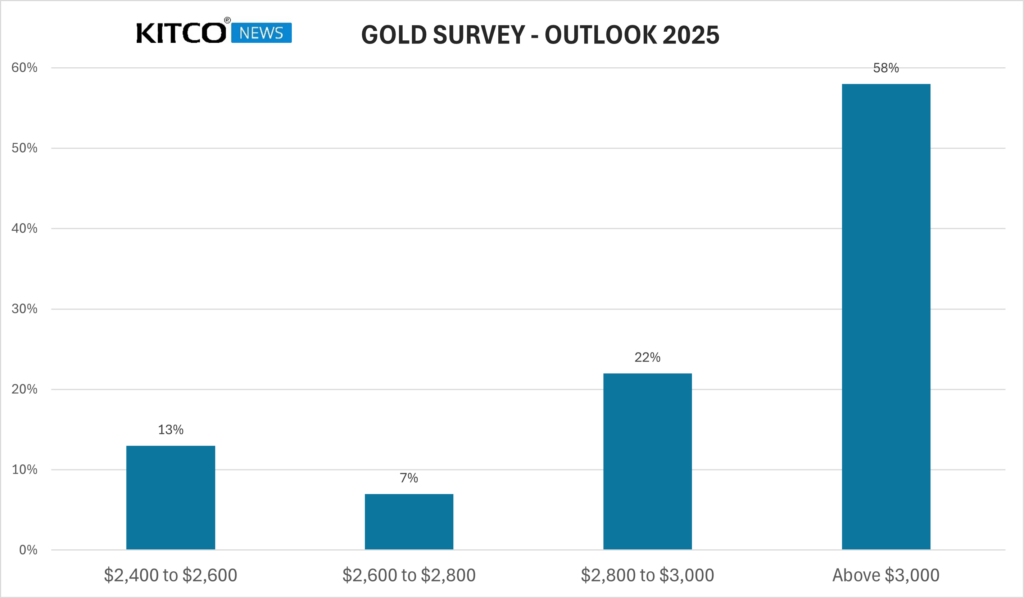

Retail Traders Expect Gold Above $3,000 in 2025

The Kitco News Annual Gold Survey revealed that 58% of retail investors believe gold will exceed $3,000 in 2025. Another 22% predict prices between $2,800 and $3,000, while only 7% see gold remaining between $2,600 and $2,800.

Key Drivers for Gold Prices in 2025

- Geopolitical Uncertainty: Trade wars, tariffs, and inflationary pressures under the new U.S. administration could bolster demand for gold as a safe-haven asset.

- Central Bank Policies: Slower interest rate cuts by the Federal Reserve may influence gold prices, with potential for a rally in the latter half of 2025.

- De-Dollarization: Countries diversifying away from the U.S. dollar into gold could sustain high demand for the yellow metal.

China’s Economic Policies and Their Impact on Gold Demand

As one of the largest consumers of gold in the world, China plays a crucial role in determining the price of gold.

Recently, reports have surfaced that the People’s Bank of China (PBoC) is considering an interest rate cut this year to support the country’s economic growth. This policy could positively affect gold demand, as a reduction in interest rates typically increases demand for safe-haven assets like gold. Moreover, Chinese President Xi Jinping has reiterated his commitment to economic growth, promising more proactive policies to boost China’s economy in 2025, which could further impact gold demand.

Challenges Ahead

Despite the optimistic outlook, factors like strong equity markets, higher bond yields, and fluctuating demand from China and India may limit gold’s upside. Analysts also warn of potential profit-taking by investors, especially after gold’s record-breaking rally in 2024.

Conclusion

Gold’s performance in 2025 will depend on a combination of macroeconomic factors, central bank policies, and geopolitical developments. While challenges persist, the consensus among retail traders and experts points to a strong likelihood of the gold price surpassing the $3,000 mark, solidifying its status as a key asset in diversified portfolios.

FAQs About Gold’s 2024 Performance and 2025 Outlook

⁉️In this section, we address your frequently asked questions related to this topic:

Gold’s rally was driven by central bank demand, inflation concerns, geopolitical tensions, and expectations of lower interest rates.

Many analysts and investors predict gold could break the $3,000 mark, especially in the second half of 2025, amid economic and geopolitical uncertainties.

High bond yields, a strong U.S. dollar, and weaker demand from major markets like China and India may hinder gold’s upward momentum.

Gold is often considered a safe-haven asset, thriving during periods of high inflation, geopolitical tension, and economic instability.

Analysts believe that geopolitical risks, inflationary pressures, and central bank dedollarization will continue to support gold’s appeal as a long-term investment.